capital gains tax rate australia

List of CGT assets and exemptions Check if your assets are subject to CGT exempt or pre. Impacts on foreign and Australian residents.

6 Resident Versus Non Resident Tax Status

To calculate the CGT.

. There is no set rate of CGT in Australia for individuals. There are several ways in which you can avoid capital gains tax. Heres a sample computation of capital gains tax on sale of property.

If youre selling a property for a total of Php 2400000 then the capital gains tax will amount to Php 144000. The rates are much less onerous. What is a Capital Gains Tax event.

Capital gains tax CGT is the tax you pay on profits from selling assets such as property. Take advantage of being an owner-occupier. Money Pty Ltd trading as.

The remaining 66650. But those in the 10 percent and 15 percent income tax brackets pay zero capital gains taxes. Trading companies on the other hand pay a flat rate of CGT 26 if their.

Fortunately when you inherit real estate the propertys tax basis is stepped up which means the value is re-adjusted to its current market value and often reduces or entirely eliminates the capital gains tax owed by the beneficiaryFor example Sallys parents purchased a house years ago for 100000 and bequeathed the property to Sally. A capital gains amount could force you into a higher tax. If you originally purchased your investment property before this date you are exempt from paying capital gains tax because your asset is considered a pre-CGT asset.

The optimum capital gains tax rate is zero. It applies to real property disposals where the contract price is 750000 or more. Guide to Capital.

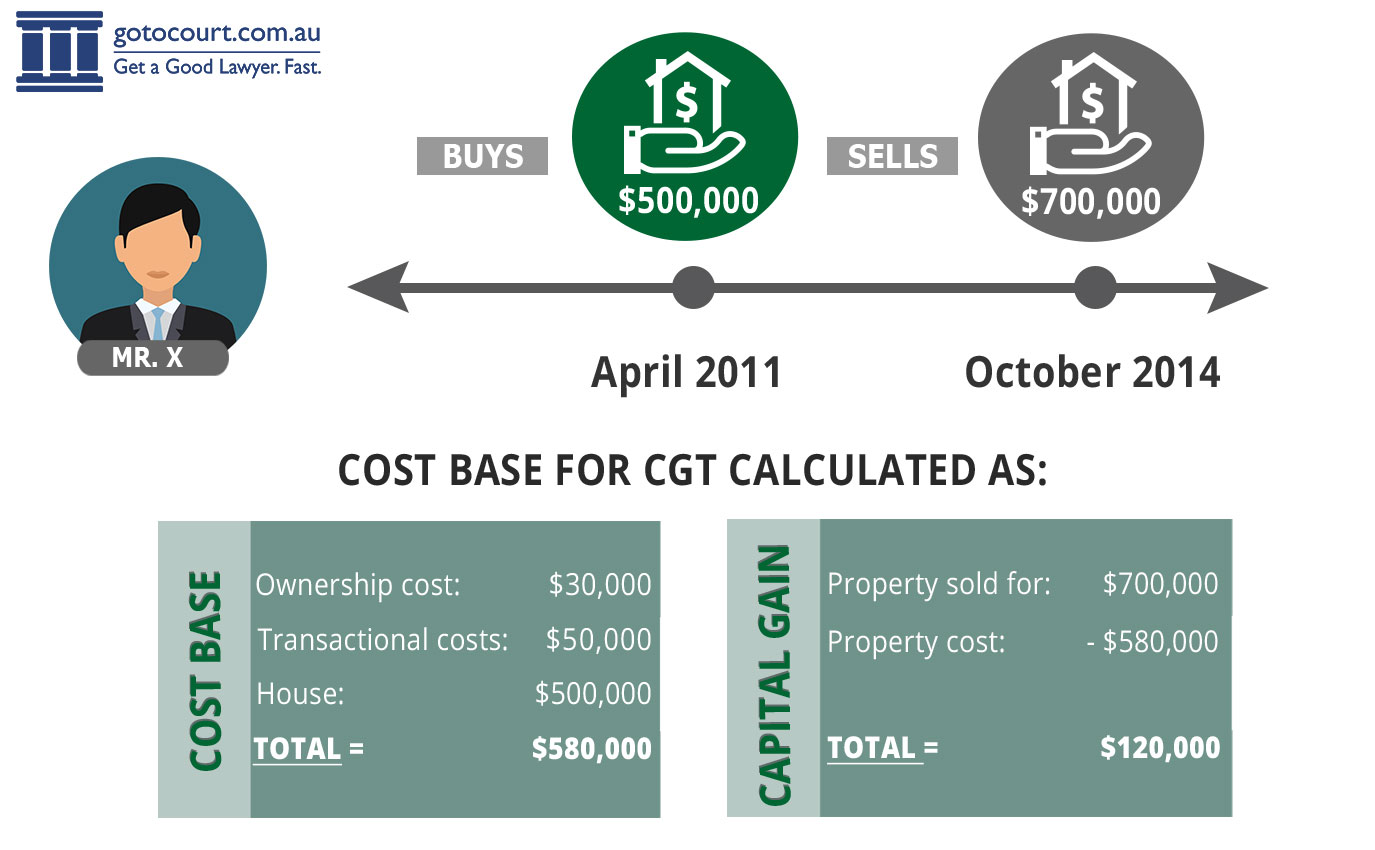

How much is capital gains tax in Australia. Expenditures Credits and Deductions. Capital gains tax is a tax you pay to the government when you make a profit by selling your investment property or something else of value for more than you originally paid for it.

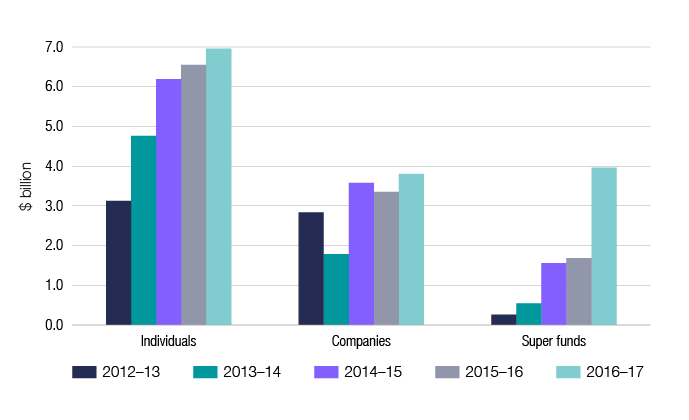

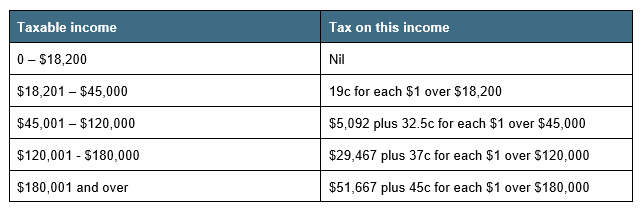

A capital gains tax CGT was introduced in Australia on 20 September 1985. The 0 bracket for long-term capital gains is close to the current 10 and 12 tax brackets for ordinary income while the 15 rate for gains corresponds somewhat to the 22 to 35 bracket levels. Capital gains taxes on assets held for a year or less correspond to ordinary income tax.

And for an SMSF the tax rate is 15 and the discount is 333 rather than 50 for individuals. Many countries including the US the UK Canada and Australia assess capital gains taxes on any profit you make from the sale of a home. Its important to note that any capital gains amount will be added to your current income before calculating the tax rate ie.

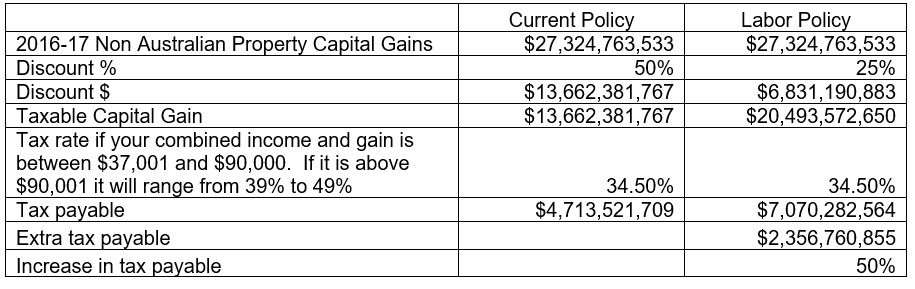

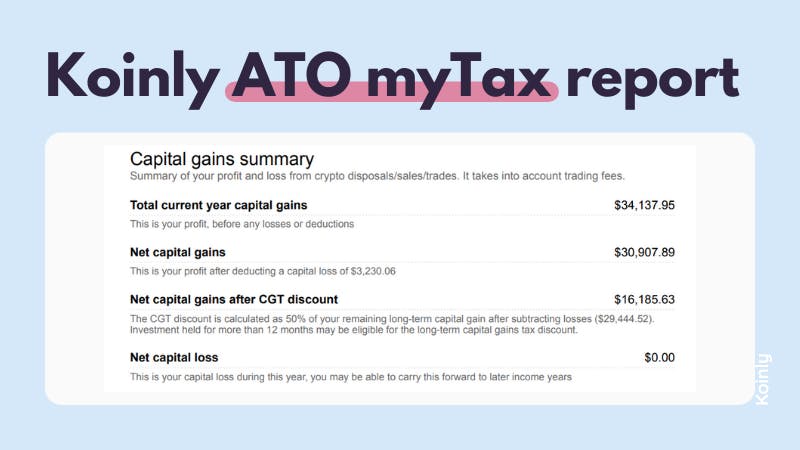

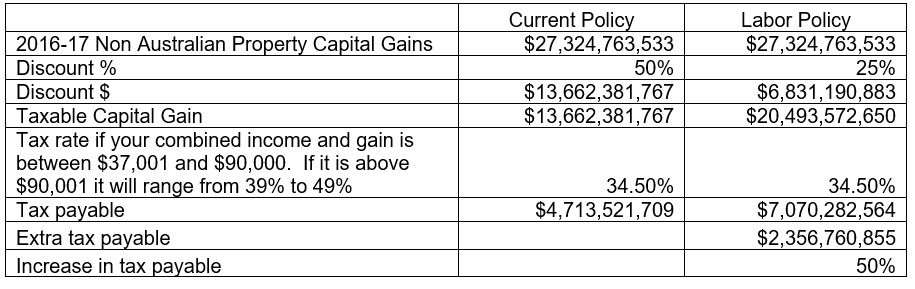

In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. A discount of 50 can be applied to capital gains if you have owned the investment for more than 12 months. 20 of a taxpayers net capital gain was included in income to calculate the taxpayers average tax rate and the average rate was then applied to all the taxpayers gross income ie including the capital gain in full.

If you own the asset for more than twelve. Foreign resident capital gains withholding FRCGW applies to vendors disposing of certain taxable property under contracts entered into from 1 July 2016. The FRCGW tax rate is 125.

Many people qualify for a 0 tax rate. And youll pay a 30 tax on any net capital gains. Angola Last reviewed 19 July 2022 Capital gains arising from the disposal of financial.

The first one is main residence exemption. The capital gains tax was introduced on 20 September 1985. Capital Gains and Dividends Taxes.

Instead you pay CGT at your marginal rate of tax if you need to pay it. The rates are much less. For example if you spent 310000 on buying a house years ago and sold it for 500000 today then your capital gains would be 190000 and youd have to.

If you live in the property right after acquiring it the asset can be listed as your Primary Place Of Residence PPORThat makes it exempt from CGT. Tax Foundation is Americas leading independent tax policy resource providing trusted nonpartisan tax data research and analysis since 1937. Youll pay taxes on your ordinary income first and then pay a 0 capital gains rate on the first 33350 in gains because that portion of your total income is below 83350.

The maximum capital gain tax rate is 20 percent. How to avoid capital gains tax in Australia 1. Capital gains tax is levied at an investors marginal tax rate.

Tax Compliance and Complexity. Long-term capital gains tax rates typically apply if you owned the asset for more than a year. Capital Gains Tax Exemptions or Discounts.

Capital gains withholding. While the sale of your primary residence typically is excluded you usually must pay capital gains taxes if you make a profit on the sale of your secondary home. Main residence exemption allows homeowners to avoid paying capital gains tax if their property is their principal place of residence PPOR.

For 2015 that group includes singles with less than 37450 in taxable income or joint filers with taxable income under 74900. Headline corporate capital gains tax rate Headline individual capital gains tax rate Albania Last reviewed 21 June 2022 15. How to legally avoid or reduce Capital Gains Tax in Australia.

On the other hand if the current fair market value of the property amounts to Php 2800000 and not Php 2400000 then the total capital gains tax for the. Estate and Gift Taxes. Conversely since capital gains taxes have been raised the slowing of economic growth could reduce tax revenue by more than the additional tax collected.

Netting gains and losses. Avoiding Capital Gains Tax. While self-managed super funds only attract a one-third discount for CGT the standard tax rate for funds is only 15 per cent meaning the maximum CGT rate is 10 per cent.

2022 Capital Gains Tax Calculator accurately works out your CGT on shares property investments. Algeria Last reviewed 01 June 2022 Capital gains are subject to the normal CIT rate. For individuals capital gains tax is calculated at the same rate as your income tax.

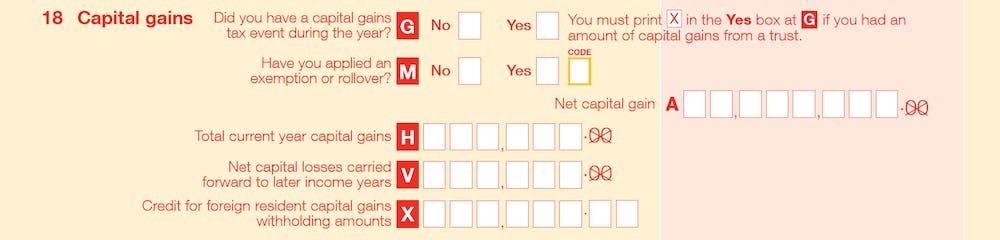

What is capital gains tax. How to calculate capital gains tax CGT on your assets assets that are affected and the CGT discount. How capital gains tax CGT works and how you report and pay tax on capital gains when you sell assets.

Capital Gains Tax CGT is a tax you pay on the sale of non-exempt assets in Australia that were acquired after the 20 September 1985.

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Capital Gains Tax Australian Taxation Office

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Capital Gains Tax Cgt Calculator For Australian Investors

Capital Gains Tax Building Depreciation Home Property Management Residential Property Management In Launceston Tasmania

2019 Year End Tax Planning Guide Mazars Australia

Capital Gains Tax Cgt Calculator For Australian Investors

Calculating Capital Gains Tax Cgt In Australia

Tax Rates In Us And Australia Download Table

Capital Gains Tax Cgt What To Know Before You Sell Your Investment Property Rent Blog

End Of Financial Year Guide 2021 Lexology

Capital Gains Tax Cgt Calculator For Australian Investors

How To Minimise Capital Gains Tax Cgt

Filing Your Australia Crypto Tax Here S What The Ato Wants Koinly

Is Bill Shorten S Changes To Capital Gains Tax Just Revenue Raising

Make Tax Free Capital Gains On Australian Shares Whilst A Non Resident Expat Expat Taxes Australia